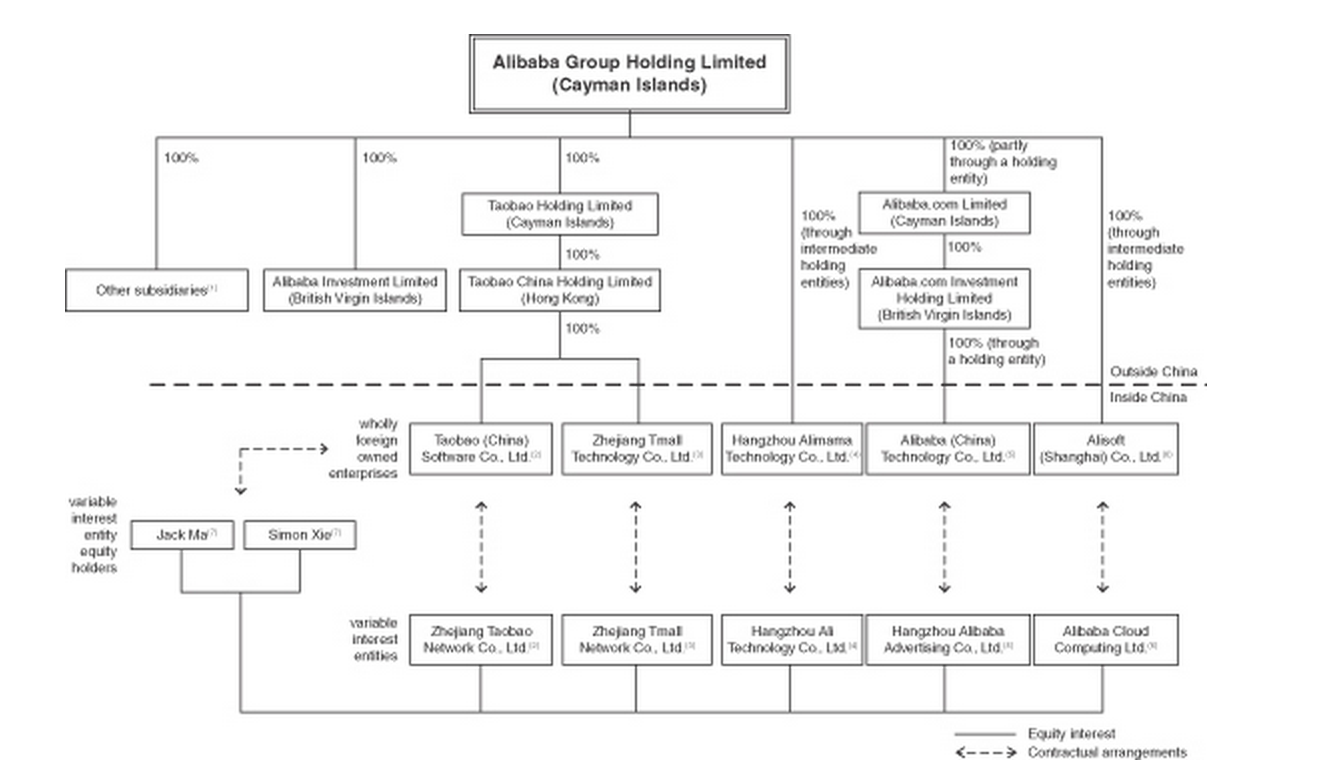

I have multiple clients where they formed separate entities for different aspects of their business(es). While the business enterprise may have a common goal, I try to ensure that each entity has and maintains it’s own identity. Otherwise, the “walls” or “separateness” between the entities can be disregarded and the liabilities of one entity can be attributed to the entire enterprise. Texas has what is known as the single business enterprise doctrine, explained below.

I have multiple clients where they formed separate entities for different aspects of their business(es). While the business enterprise may have a common goal, I try to ensure that each entity has and maintains it’s own identity. Otherwise, the “walls” or “separateness” between the entities can be disregarded and the liabilities of one entity can be attributed to the entire enterprise. Texas has what is known as the single business enterprise doctrine, explained below.

“The single business enterprise doctrine applies when two or more business entities act as one. Nichols, 151 F. Supp.2d at 781–82 (citing Beneficial Personnel Serv. of Texas v. Rey, 927 S.W.2d 157, 165 (Tex. App.- El Paso 1996, pet. granted, judgm’t vacated w.r.m., 938 S.W.2d 717 (Tex. 1997)). Under the doctrine, when corporations are not operated as separate entities, but integrate their resources to achieve a common business purpose, “each corporation may be held liable for debts incurred during the pursuit of the common business purpose.”Western Oil & Gas J.V., Inc., v. Griffiths, No. 300-cv-2770N, 2002 WL 32319043, at *5 (N.D. Tex. Oct. 28, 2002) (internal citations omitted).”

So, if you have more than one business entity, make sure that any transactions between them are at “arms-length” as if between unrelated parties, Otherwise, the “separateness” may be disregarded.