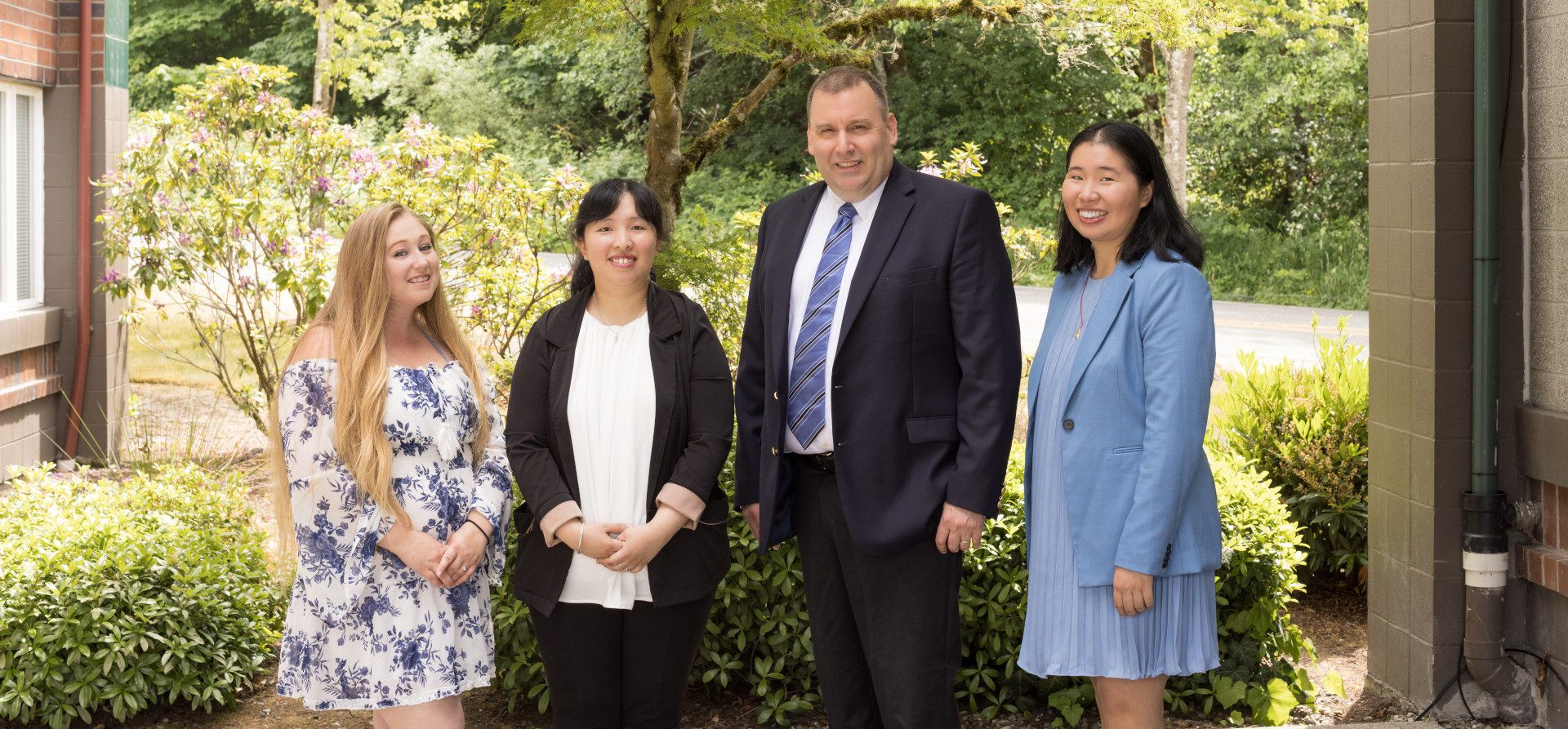

Tax Law

Experienced, Professional Counsel & Representation

NorthStar Law Group, P.S. provides clients throughout Washington and the Pacific Northwest with concrete solutions for their serious tax liabilities. If you’re facing an IRS or Washington Department of Revenue audit or those agencies are taking aggressive collection measures against you, we have the qualifications and experience to fight for a positive outcome. Clients come to us because they value our insights, perceptiveness, and fast understanding of their situations. We are confident that you will, too.